Ichimoku Kinko Hyo

This is a practical guide which will help you to use

Ichimoku in your trading.

Ichimoku Kinko Hyo is a Japanese

investing technique. It provides all – trading signals, resistance and support

levels. It is very different from normal western techniques such as trading

with moving averages, but after a while you should understand it easily. It was

created around 50 years ago by Japanese journalist Goichi Hosoda. He started to

work on Ichimoku before World War II. To the West, this technique is know from

90s, just like candles it was unknown for many decades.

First, let’s see how Ichimoku is build. Later we will check

how it can be used in trading stocks and Forex.

Ichimoku components

Ichimoku Kinko Hyo is build from 5 averages (notice – these

are different averages than standard moving average that you know):

·

Senkou Span A and Senkou Span B –

area between them is called Kumo, or simply just Ichimoku cloud. This is a

resistance and support area

·

Kijun-Sen – longer signal average

·

Tenkan-Sen – shorter signal average

·

Chikou Span – this average is

shifted back by 26 periods

So when we put this together, we’ve got a ready investing

system:

|

| ichimoku components |

Time to learn more about each component.

Kumo (Ichimoku cloud)

Usually, we look for support or resistance right at moving

average or support line. Ichimoku cloud is different – it is area of possible

resistance or support. The thicker cloud is, the stronger resistance or support

should be at this place. If cloud is thin, than possible support/resistance

should be weak.

|

| thin and thick ichimoku cloud |

When price manage to break out or break down from cloud,

then this is a strong signal to take position, because it happens rarely.

price

break from cloud – examples

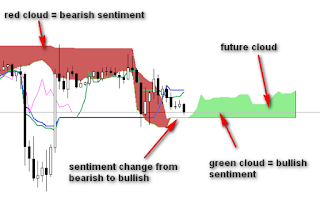

There is one more interesting thing about cloud. It is

shifted forward, this part is called future kumo. When future kumo changes

color from red to green, then there is a shift in sentiment.

Cloud has two colors – one (usually red) when the sentiment

is bearish, and second (most often green) when sentiment is bullish.

|

| future kumo and cloud colors |

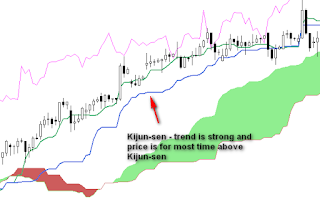

Kijun Sen

It is longer average, based on 26 periods. Let’s compare

Kijun Sen and 26 moving average:

|

| kijun-sen vs. normal moving average |

As you can see, it acts different. From my experience, I can

say that Kijun Sen itself is a good resistance/support level.

|

| kijun-sen |

Tenkan Sen

It is shorter average. Based with Kijun Sen it gives signals

to buy and sell (more on that later). When trend is strong, it can also act as

support/resistance.

|

| tenkan-sen |

Chikou Span

Chikou Span is a close price shifted 26 periods back. It is

little unclear, but this example should help us to understand that:

|

| chikou-span |

The main idea behind Chikou Span is that it helps to compare

current price with price from 26 periods before. The end of Chikou Span is the

current price close. Based on that we know if the current sentiment is bullish

(Chikou Span above price) or bearish (Chikou Span below price). So this is

another Ichimoku component which helps us to determine current sentiment, the

previous one was Kumo.

Chikou Span as suport/resistance

Chikou Span is following current price and it has highs and

lows because that is the way price move. We can use that points to draw support

and resistance lines.

|

| resistance lines based on chikou span |

Is this better than standard support and resistance lines?

To be honest, not so much. You can stick with standard support/resistance

levels and you will be good. Just wanted to show you that this is another

possible way of using Chikou Span.

Trading signals from Ichimoku

First, one thing need to be explained. Ichimoku Kinko Hyo

gives you picture of current situation at markets. It also comes with sets of

trading signals. That does not mean that you have to stick to these signals.

You can use Ichimoku as a base to build your own trading system. That’s what I

did and from what I know, many other traders.

Tenkan and Kijun Sen cross

This is a first signal we can take. When shorter average

Tenkan crosses with Kijun from the bottom, then this is a buy signal. There are

three types of buy signal: weak, medium, strong.

Weak buy signal – cross below cloud

|

| weak buy signal |

Medium buy signal – cross inside cloud

|

| medium buy signal |

Strong buy signal – cross above cloud

|

| strong buy signal |

That make sense. When buy signal occurs below cloud, that

means that resistance area is above so sentiment is more bearish at the moment.

When buy signal occurs above cloud, then sentiment is bullish, there is no

strong resistance above.

Similar situation is with sell signal (signal to take short

position). There are three types of sell signal: weak, medium, strong.

Weak sell signal – cross above cloud

|

| weak sell signal |

Medium sell signal – cross inside cloud

|

| medium sell signal |

Strong sell signal – cross below cloud

|

| strong sell signal |

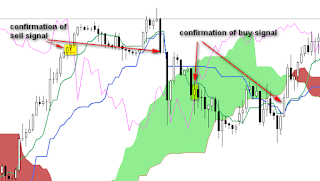

Confirmation from Chikou Span

When you take signals based on cross of Tenkan Sen and Kijun

Sen, then you may want to wait for confirmation from Chikou Span. This is

optional, and many traders do not use this that way.

Let’s say that there is a buy signal from Kijun and Tenkan Sen. Then we wait for confirmation from Chikou Span – so the moment when Chikou Span will cross the price.

Let’s say that there is a buy signal from Kijun and Tenkan Sen. Then we wait for confirmation from Chikou Span – so the moment when Chikou Span will cross the price.

Check following example:

|

| confirmation from chikou span |

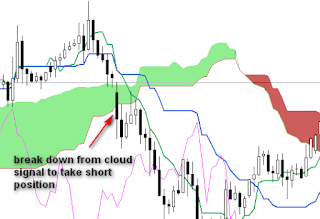

Breakout from Ichimoku cloud

This is my favorite signal to take position. By now you know

that cloud acts as a support when price is above Ichimoku cloud and as

resistance when price is below cloud. It is not that often when price changes

sides. When it happens, then it is a sign that there is a shift in sentiment.

When price is below cloud and it breaks up, then it is a signal

to take long position.

|

| break out from cloud |

When price is above cloud and it breaks down from the cloud,

then it is signal to go short.

|

| break down from cloud |

The good idea is to place stop loss on the other side of

cloud. This signal may be very effective – check how it works on weekly time

frame. Of course it works also on lower time frames.

Break above/below Kijun Sen

Another signal to take position. Kijun Sen is longer average

and when price break above Kijun Sen, then this may be signal to buy.

|

| kijun-sen – signal to go long |

When it breaks below Kijun, then this is a sell.

|

| kijun-sen – signal to short |

It is similar to normal averages – when price breaks above

50 or 200 moving average, then many traders go long.

When to close trade

Normally we close the trade when there is another cross of

Kijun and Tenkan Sen:

You will notice fast that this signal is very slow. When the

move ends, there is often strong sell off and you may lose most of your profit.

Is there a better way?

I recommend three options:

·

Exit trade when price close on the

other side of Kijun sen.

·

Exit trade when price closes below

recent low (in an uptrend). So basically, you are rising your stop loss every

time new low is made.

·

Join Ichimoku with oscillator and

close based on signal from it.

Check examples to see how it works in practice.

Best time frame for Ichimoku

Ichimoku Kinko Hyo works on every time frame. In my opinion,

on lower time frames Ichimoku is less accurate. It is because on lower time

frames moves are more rapid. On lower times automated trading is very popular,

but it affects the way price move. On the other hand it does not mean that

there are no trends on lower time frames and where we have trends, there we can

trade with Ichimoku.

You have to test what time frames works best for you. I have

very good results with longer time frames, even as long as weekly and monthly.

Let’s look at weekly Apple chart. We know now that Apple is in very strong

uptrend since 2009, but it wasn’t that clear few years back. How does it look

on weekly chart?

|

| weekly Apple chart and ichimoku |

We can see that there was a breakout from cloud. In years

2006-1014 breakout from cloud took place only six times. If you followed this

signal in 2009, you could make some serious money.

This is a good example that Ichimoku is great to catch big trends. On higher time frames situation is clearer, so it is a good idea to test what signals we can get from higher time frames.

This is a good example that Ichimoku is great to catch big trends. On higher time frames situation is clearer, so it is a good idea to test what signals we can get from higher time frames.

Best market for Ichimoku

Same as with time frame, Ichimoku works on every kind of

market. It does not matter if you trade stocks, Forex, or commodities. If you

have a chart and you can spot trends, then it is a good place to try Ichimoku.

EXAMPLES

Examples below show different ways of trading with Ichimoku.

Test it in practice and choose the best for you.

On daily SP500 chart we saw a break out from cloud. We took

long position and placed stop loss below cloud. After some problems in the

beginning, trends got stronger. We moved our stop loss below Kijun-sen.

Decision is that we close trade as soon as there is a close below Kijun-Sen

which happened in the end of February. Few days later there was a signal to

reenter a trade – price moved back above Kijun-sen and there was a cross of

Kijun-sen and Tenkan-sen. We took long position. Again, trade should be closed

when price will close below Kijun-sen.

|

| daily SP500 and ichimoku |

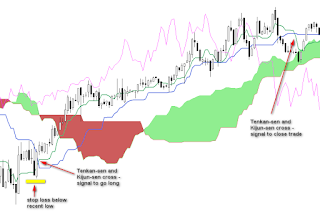

On this eurusd 5 minute chart we wait for Tenkan-sen and

Kijun-sen cross. When it happened, it was time to take long position with tight

stop loss right below recent low. We planned to close trade after another

Tenkan and Kijun-sen cross which happened after nice move up.

|

| 5 minute eur/usd |